Filing your income tax in Canada doesn’t have to be expensive or complicated. While many popular tax tools like TurboTax are U.S.-owned, there are fantastic Canadian tax software alternatives that are safe, affordable, and made specifically for Canadian tax needs.

In this guide, we’ll cover the top Canadian-made tax software, their features, pros and cons, pricing, and who each one is best for. Whether you’re filing a simple return or running a small business, you’ll find the best option for your situation—right here in Canada.

✅ Why Choose Canadian Tax Software?

When you use Canadian tax software, you’re trusting a platform that:

- Is NETFILE-certified by the CRA for secure and fast e-filing

- Follows Canadian tax rules, credits, and updates

- Keeps your sensitive financial data within Canadian borders

- Offers support tailored to Canadian taxpayers

🏆 Best Canadian-Made Tax Software Tools in 2025

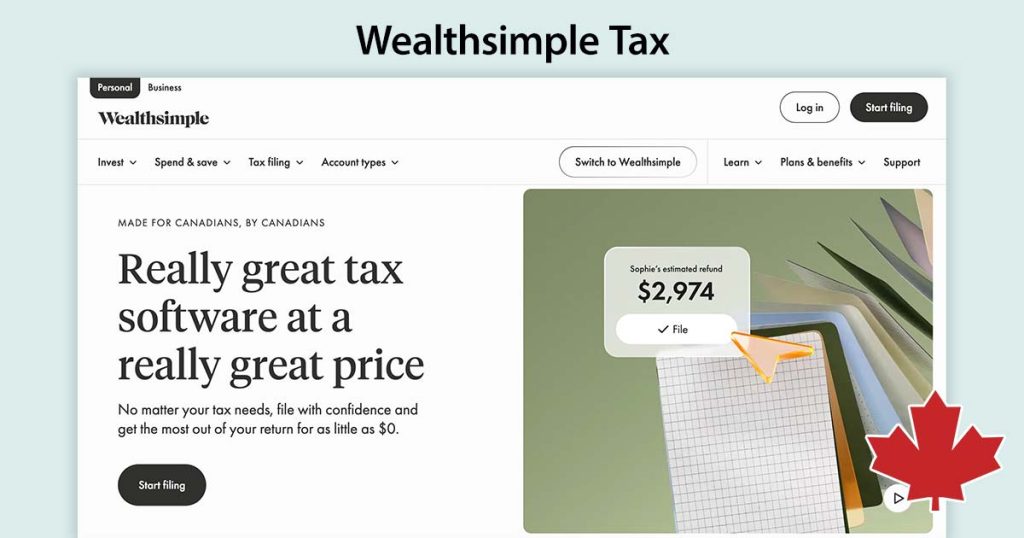

1. Wealthsimple Tax (formerly SimpleTax)

Wealthsimple Tax is a user-friendly, cloud-based tax software with a flexible pay-what-you-want pricing model.

Best For: Simple to moderate returns

Platform: Online

NETFILE Certified: ✅

Pros:

- Sleek, easy-to-use interface

- Supports self-employment, investments, and donations

- File from any device

- Option to pay $0

Cons:

- No live phone support

- May not cover complex tax scenarios

Price: Pay what you want (even $0)

👉 Try Wealthsimple Tax

2. CloudTax

CloudTax is a mobile-friendly, CRA-certified tool that offers both free and premium options. Perfect for students, salaried employees, and even some self-employed folks.

Best For: Simple to semi-complex returns

Platform: Online + App

NETFILE Certified: ✅

Pros:

- Free version available

- CloudTax Pro supports more income types

- Clean interface and easy to navigate

Cons:

- Advanced features locked behind paywall

- Less flexible than some competitors

Price: Free (basic) or $29.99 for Pro

👉 Try CloudTax

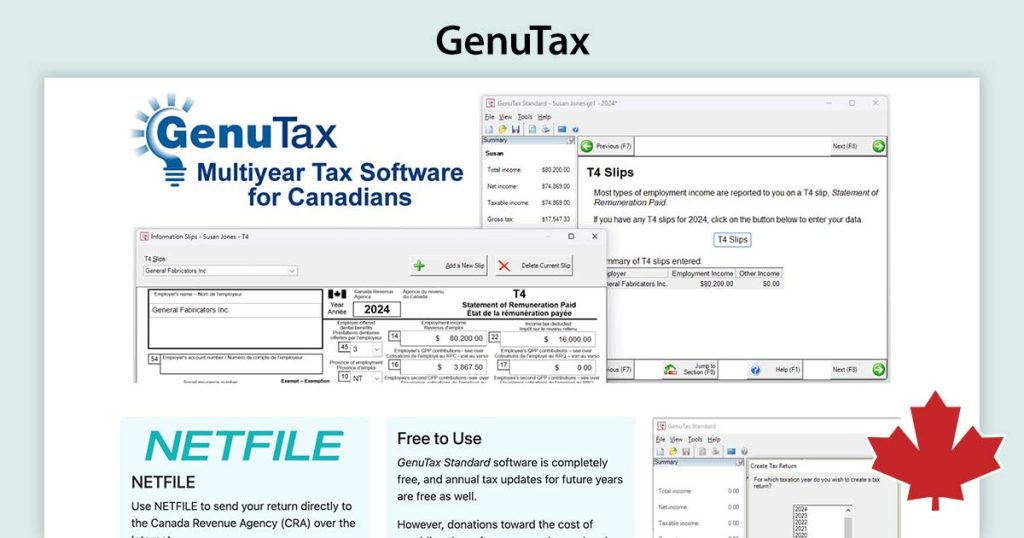

3. GenuTax Standard

GenuTax is a downloadable Windows software that’s 100% free and supports multiple tax years.

Best For: Multi-year tax filing on a budget

Platform: Windows

NETFILE Certified: ✅

Pros:

- Totally free

- Handles tax returns from previous years

- Includes self-employment and capital gains

Cons:

- Windows only (no Mac or mobile)

- Interface feels outdated

Price: Free

👉 Download GenuTax

4. UFile

UFile is a powerful Canadian tax software available both online and as a desktop version. It’s popular with self-employed individuals and those with investments.

Best For: Complex returns, including self-employment

Platform: Online + Desktop

NETFILE Certified: ✅

Pros:

- Handles many tax scenarios

- Free for post-secondary students

- Step-by-step guidance

Cons:

- Not free for most users

- UI can feel clunky for beginners

Price: From $19.99 (basic) to $39.99 (self-employed)

👉 Try UFile

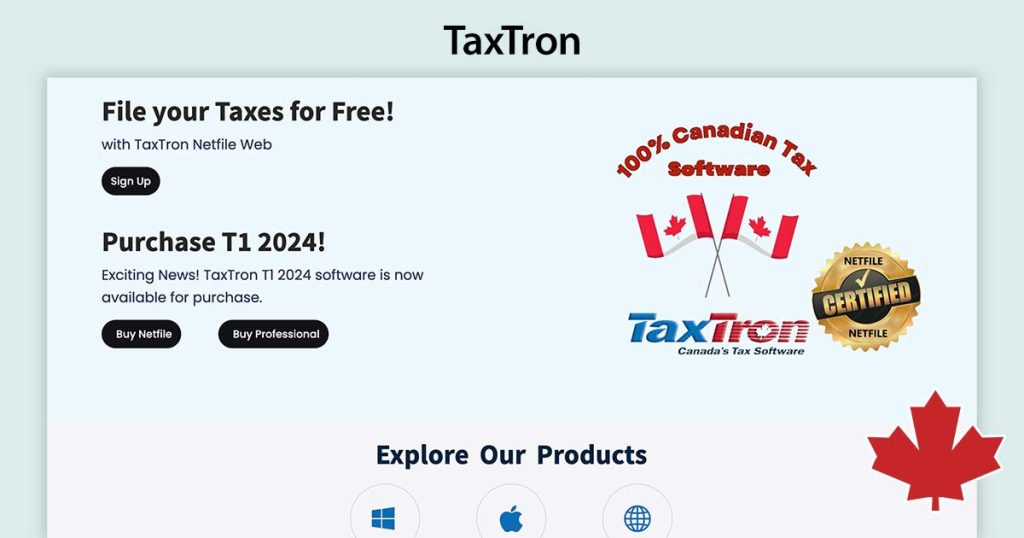

5. TaxTron

TaxTron is a robust tax tool for both individuals and corporations, with versions for Windows and Mac.

Best For: Accountants, corporate taxes

Platform: Desktop

NETFILE Certified: ✅

Pros:

- Handles personal and business returns

- Reliable for professional tax filers

- Mac and Windows versions

Cons:

- Outdated interface

- Learning curve for new users

Price: $12.99 (personal) / $99.99+ (corporate)

👉 Explore TaxTron

🧾 Side-by-Side Comparison

| Software | Best For | Free Option | Price Range | Platform | NETFILE |

|---|---|---|---|---|---|

| Wealthsimple Tax | Simple to moderate returns | ✅ | Pay-what-you-want | Online | ✅ |

| CloudTax | Simple & Pro returns | ✅ | Free / $29.99 | Online + App | ✅ |

| GenuTax | Free multi-year returns | ✅ | Free | Windows | ✅ |

| UFile | Complex, self-employed | ✅ (students) | $19.99 – $39.99 | Online/Desktop | ✅ |

| TaxTron | Personal & corporate returns | ❌ | $12.99 – $99.99+ | Desktop | ✅ |

🔍 Final Thoughts: Which Canadian Tax Software Should You Choose?

If you’re looking for the most affordable tax software, try GenuTax or Wealthsimple Tax. For mobile filing, CloudTax is a great choice. If you’re self-employed or have investment income, go with UFile. And for corporate returns or advanced filing needs, TaxTron is your best bet.

Each tool listed above is certified by the CRA and offers varying levels of support and features, so choose the one that fits your tax situation and comfort level.

Ready to file your taxes the Canadian way?

Choose the software that fits you best and file your return quickly and securely—with tools made in Canada!

Leave a Reply